How Does a Credit Card Balance Transfer Process Work?

The percentage you're charged on an unpaid balance, cash advance or balance transfer. Searching for more credit card terms? Check out our glossary Page 1 statement details 1. Your account at a glance a) Previous balance is the total balance that appeared on your last credit card statement.

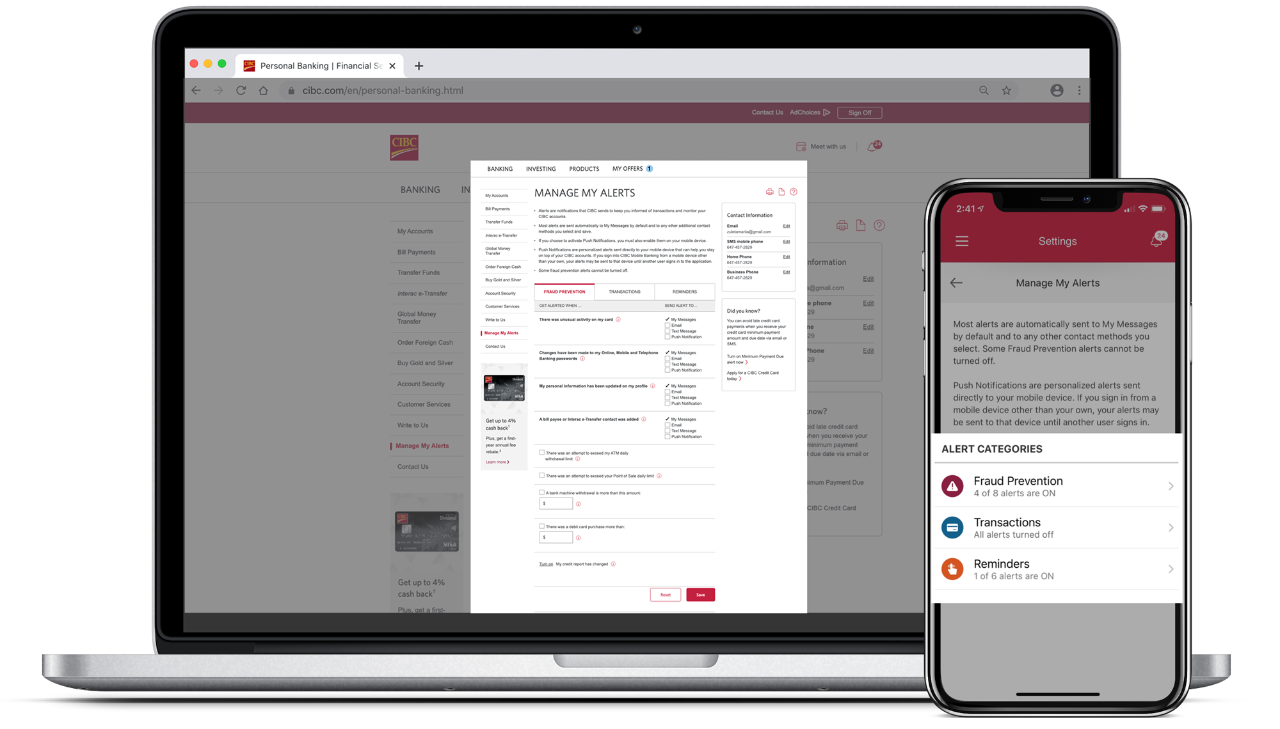

Manage Your Money with Balance Alerts CIBC

1. Canada's overall best balance transfer credit card MBNA True Line Mastercard 5.0 Genius Rating 2.9 (8) User reviews ×2 Award winner $100 GeniusCash + 0% on balance transfers for 12 months (3% fee) + No annual fee. Annual fee $0 Learn more

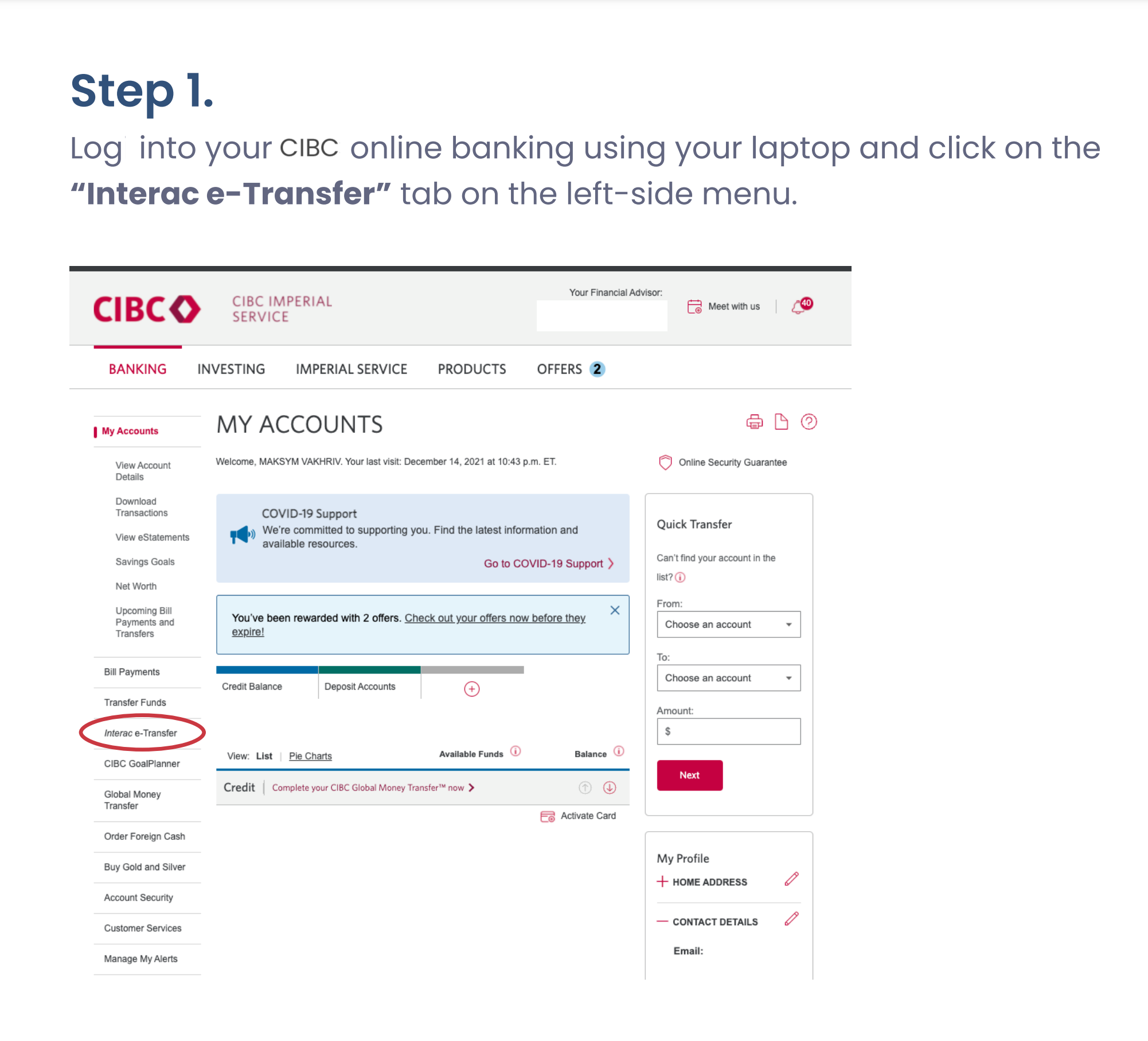

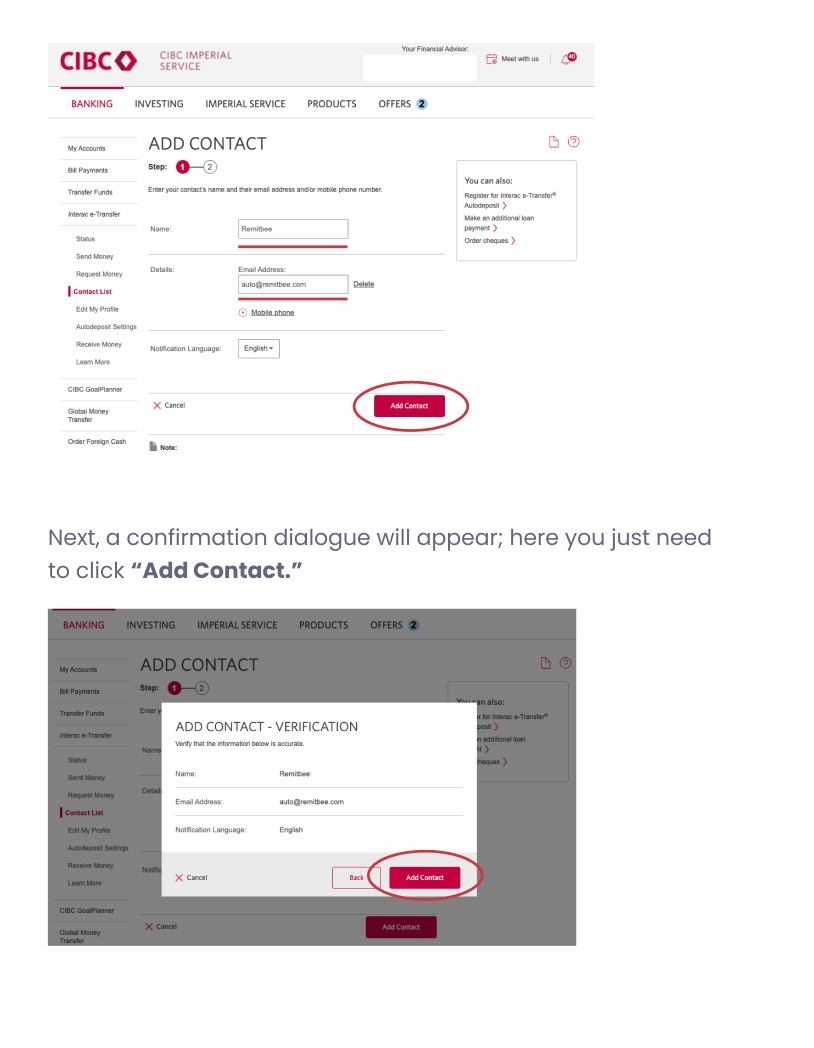

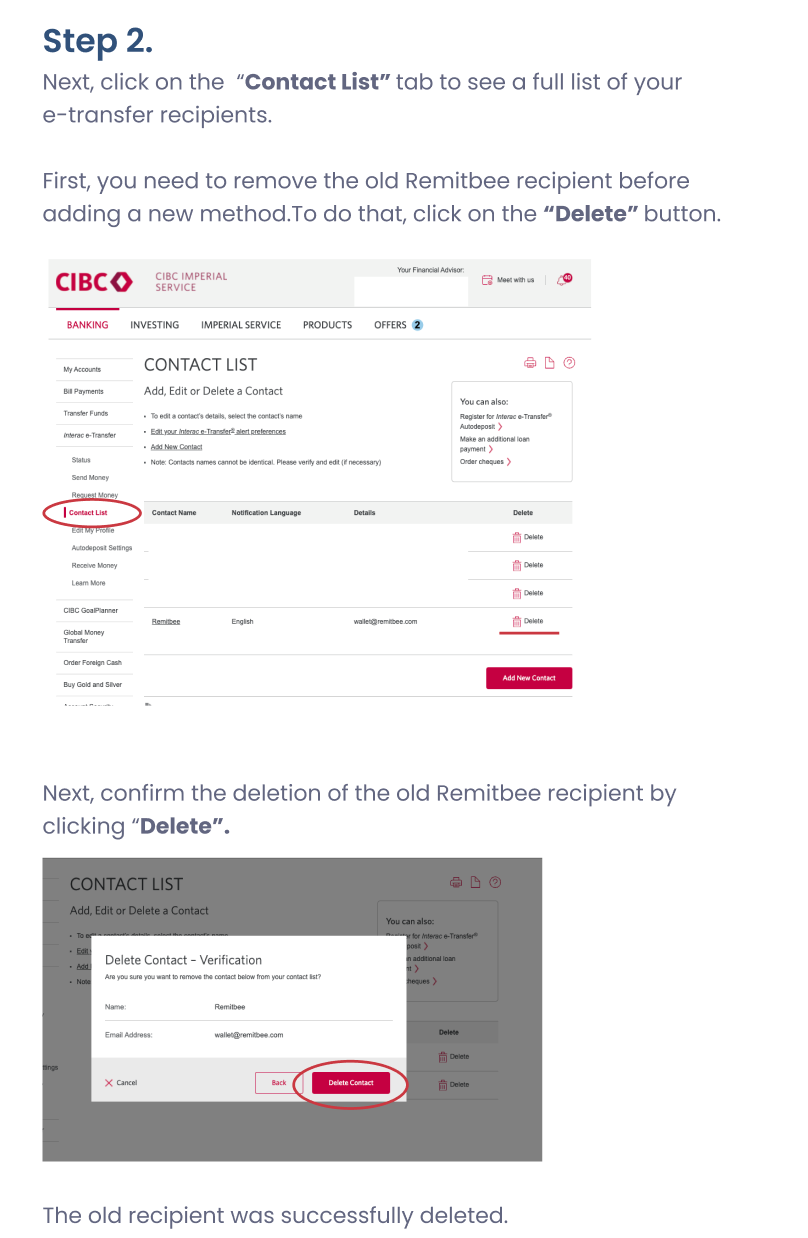

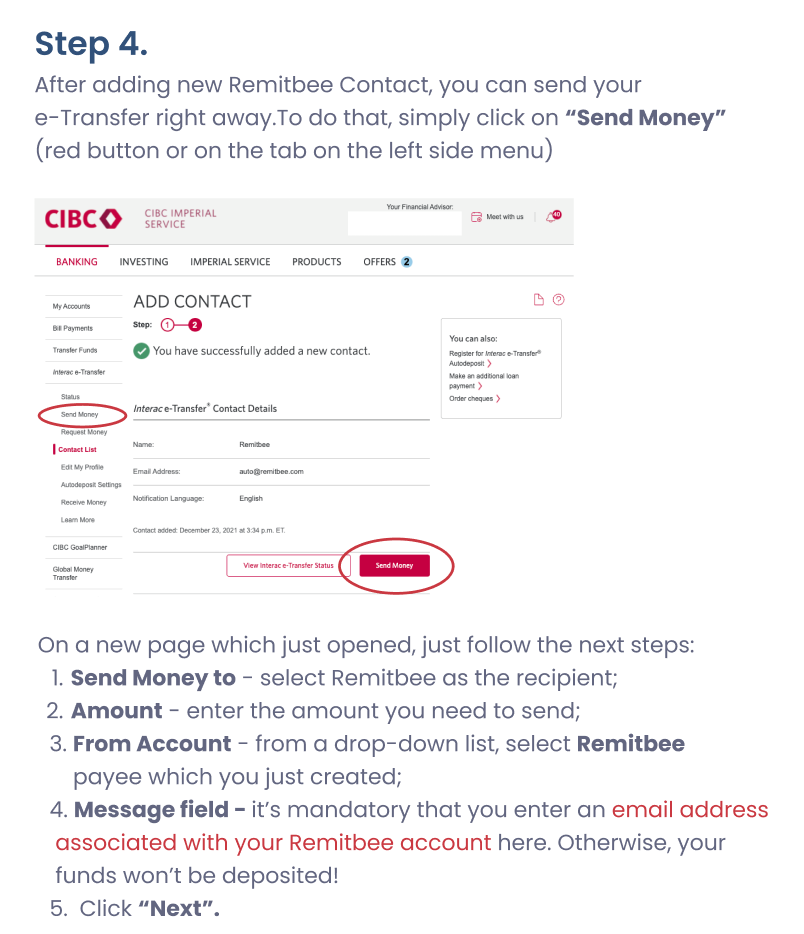

How to add e transfer to CIBC Remitbee Help Center

0% Intro APR on Purchases. 0% APR on Balance Transfers for Nearly Two Years. Best Balance Transfer Offers. 0% APR on New Purchases and Balance Transfers.

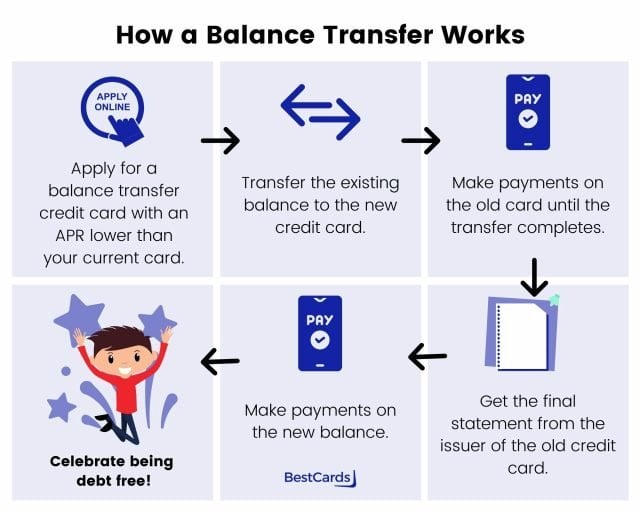

9 diagrams that explain balance transfer credit cards

Use CIBC NetBanking to check your balance, transfer funds between your CIBC Bank USA accounts and get eStatements. Feel confident knowing your Agility Savings Account is FDIC insured up to applicable limits.

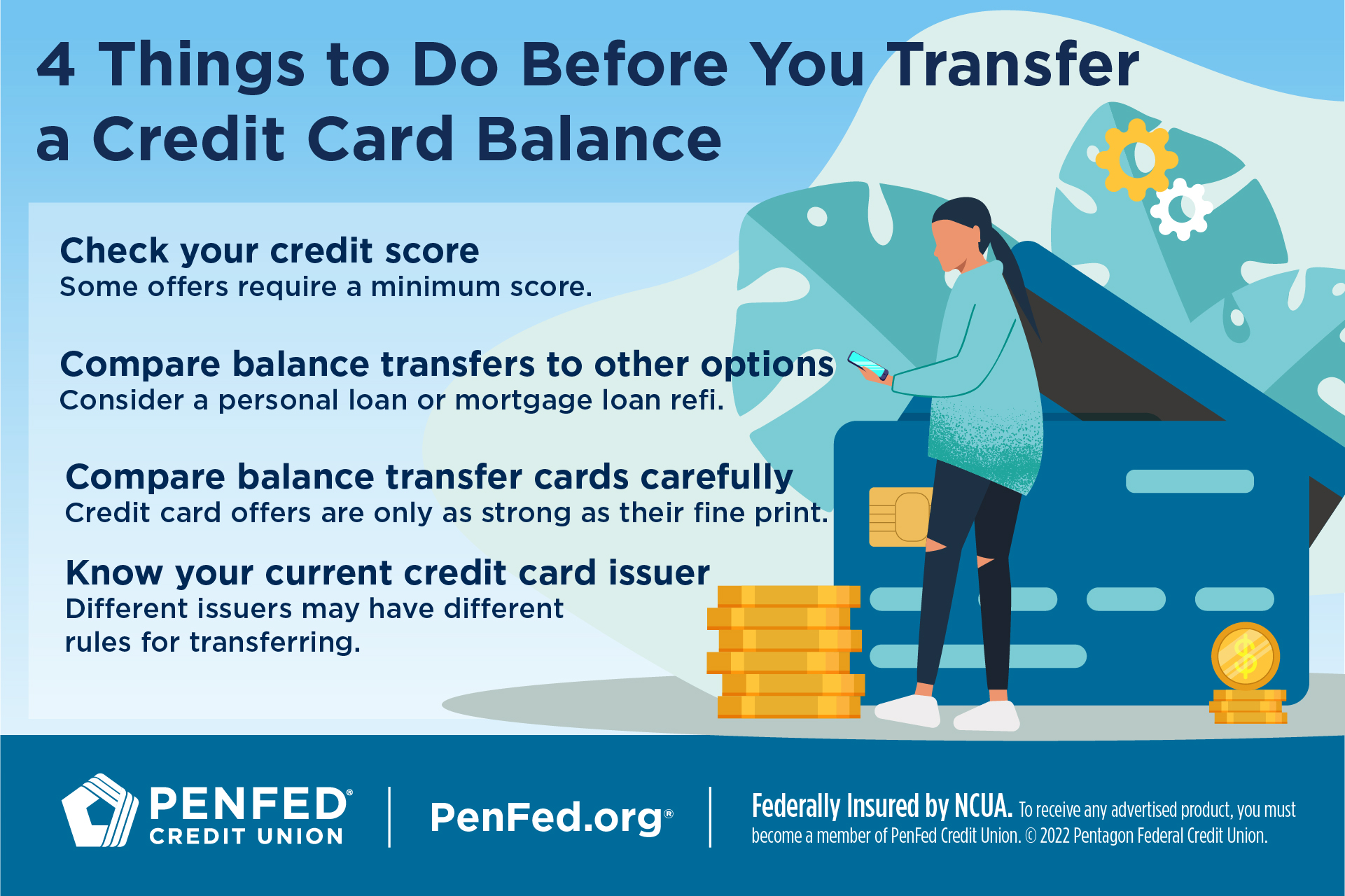

What to Look for in a Balance Transfer Credit Card

13.99 % Balance Transfer Rates 13.99 % See all cards from CIBC Offer Card Awards Fees & Conditions Insurance Alternative Cards Legal Offer Transfer your credit card balance - Get 0% interest for up to 10 months with a 1% transfer fee † and a first year annual fee rebate † Check full offer details below †

How to do a balance transfer on credit cards 3 easy steps Foster The

The CIBC Select Visa* Card's 0% interest rate for 10 months (1% transfer fee) is a pretty great deal for a balance transfer credit card, and its post-promotional rate is quite competitive as.

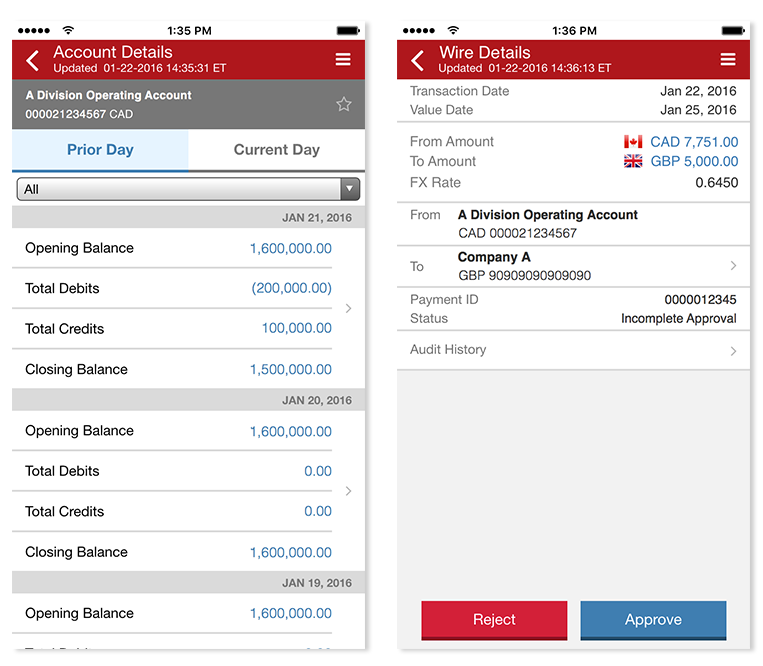

CIBC Mobile Banking App Rated the Top in Canada CIBC

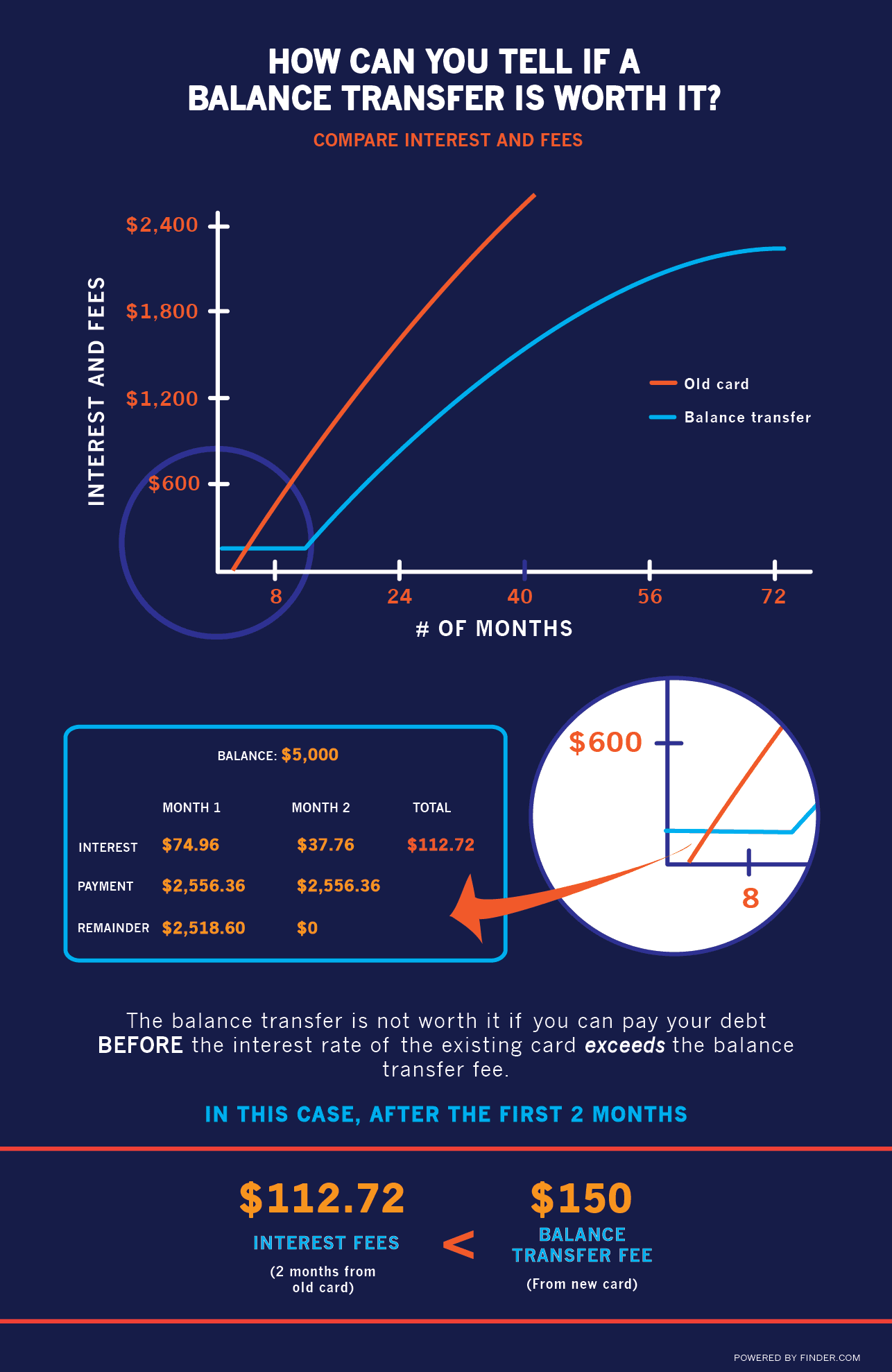

A balance transfer is a smart way to cut down (and sometimes even eliminate) interest for a limited time and therefore speed up your journey to financial freedom. But, as with any tool, you need to know how to use it properly and balance transfers can be tricky. Here's everything you need to know about balance transfers. What's a balance transfer?

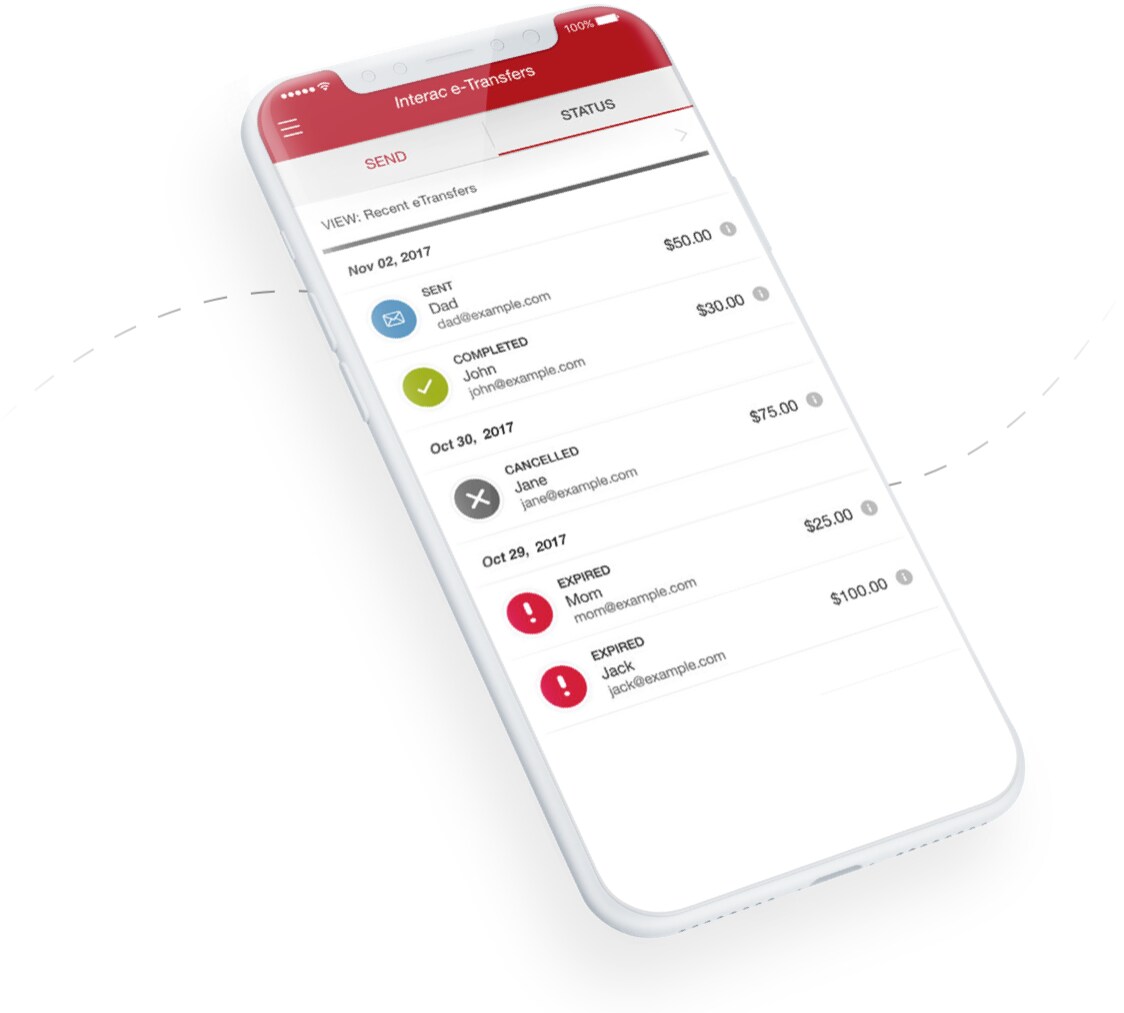

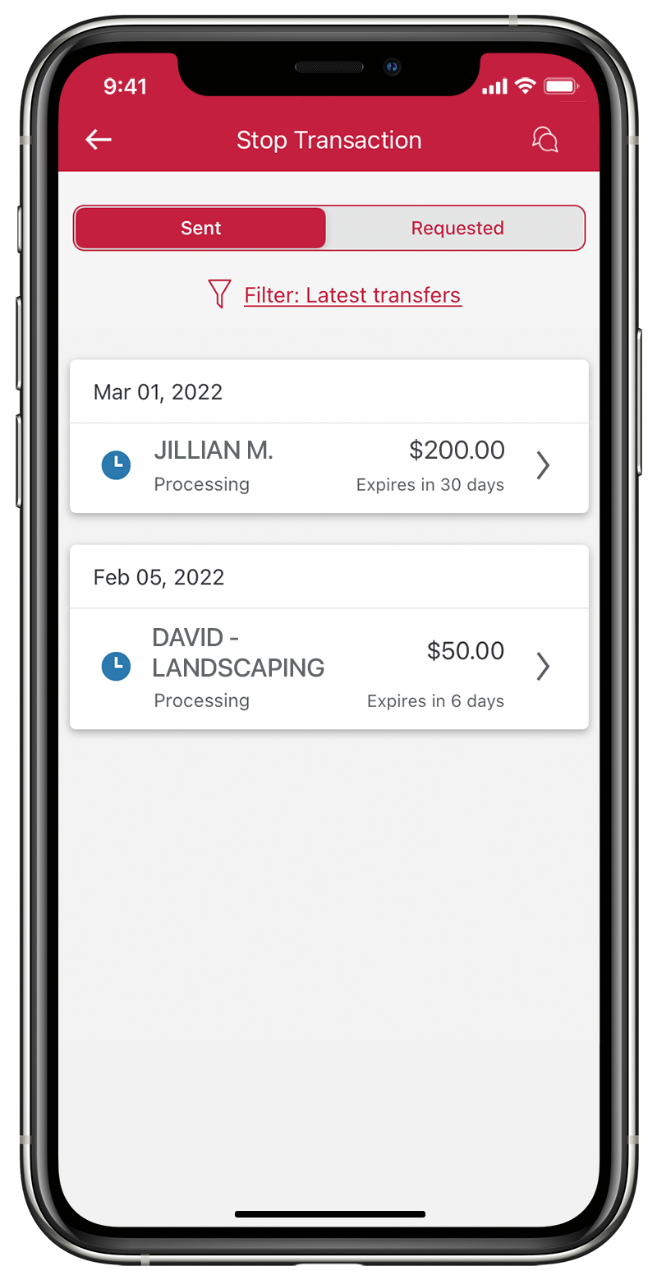

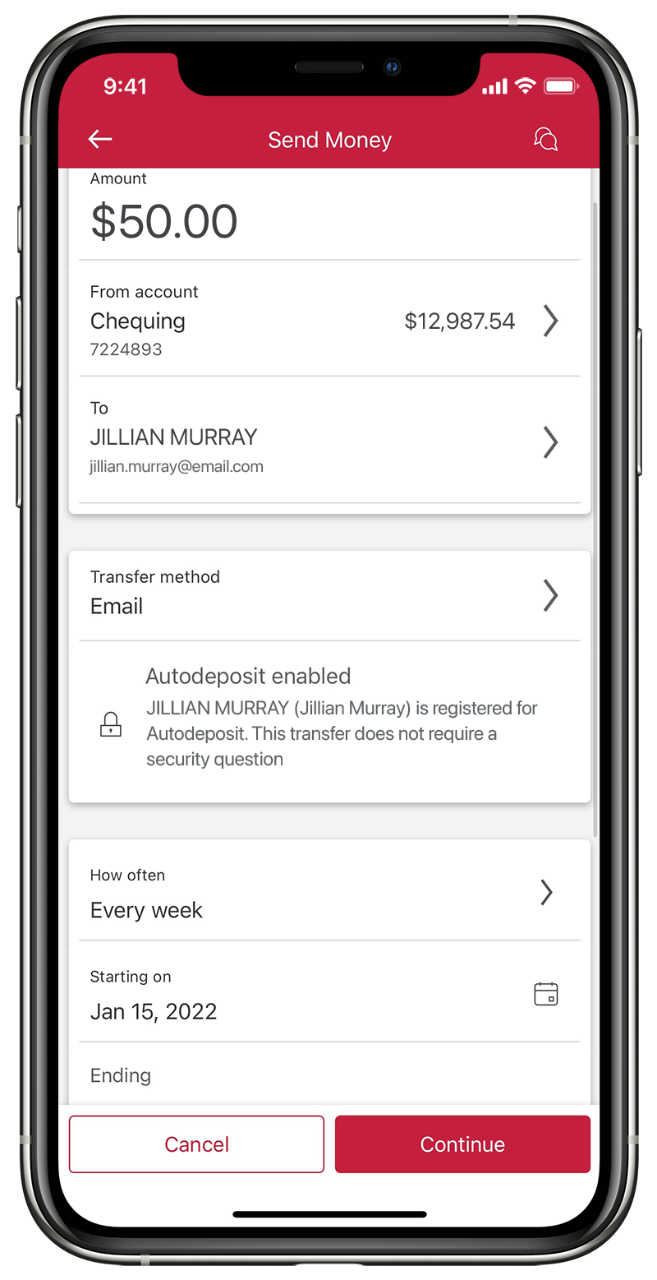

How to send and receive money with Interac eTransfer at CIBC

Transfer your credit card balance — get 0% interest for up to 10 months with a 1% transfer fee † and a first year annual fee rebate ‡ . Show more offer details Apply now $15,000 minimum annual household income Fees and interest rates Annual fee $29 — first year rebated ‡ $0 for up to 3 additional cards Purchase interest rate 1 13.99%

How to add e transfer to CIBC Remitbee Help Center

SimplifyMentor CIBC Online Banking and Mobile Banking allows you to check your account balance and make transfers between your CIBC accounts. Watch this video to learn more!

CIBC Mobile Business App

1 MBNA True Line Mastercard Apply Now On MBNA's Website Welcome Bonus 0% interest for 12 months on balance transfers within 90 days of account opening, with a 3% transfer fee Annual Fee $0.

CIBC Global Money Transfer™ Do It Online YouTube

CIBC select visa balance transfer warning! Meta. I applied for the CIBC select visa for a balance transfer due to the 0% promotional interest rate. There is a condition that says you'll only get up to 50% of the cards value for a balance transfer and it MUST be done during the time of application. (you can transfer for up to 3 cards) I've never.

Best Balance Transfer Credit Cards For 2021 creditcardGenius

Best card for a low-interest and balance transfer offer CIBC Select Visa* Card. Annual Fee. $29 Waived first year Intro Interest Rates. 0% interest rate on balance transfers for 10 months.

How to send and receive money with Interac eTransfer at CIBC

Annual fee: $29 APPLY NOW Tangerine Money-Back Credit Card Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases. Welcome offer: Get an extra 10% cash back on up to $1,000 in spending in the first 2 months ($100 value); 1.95% balance transfer rate for 6 months.

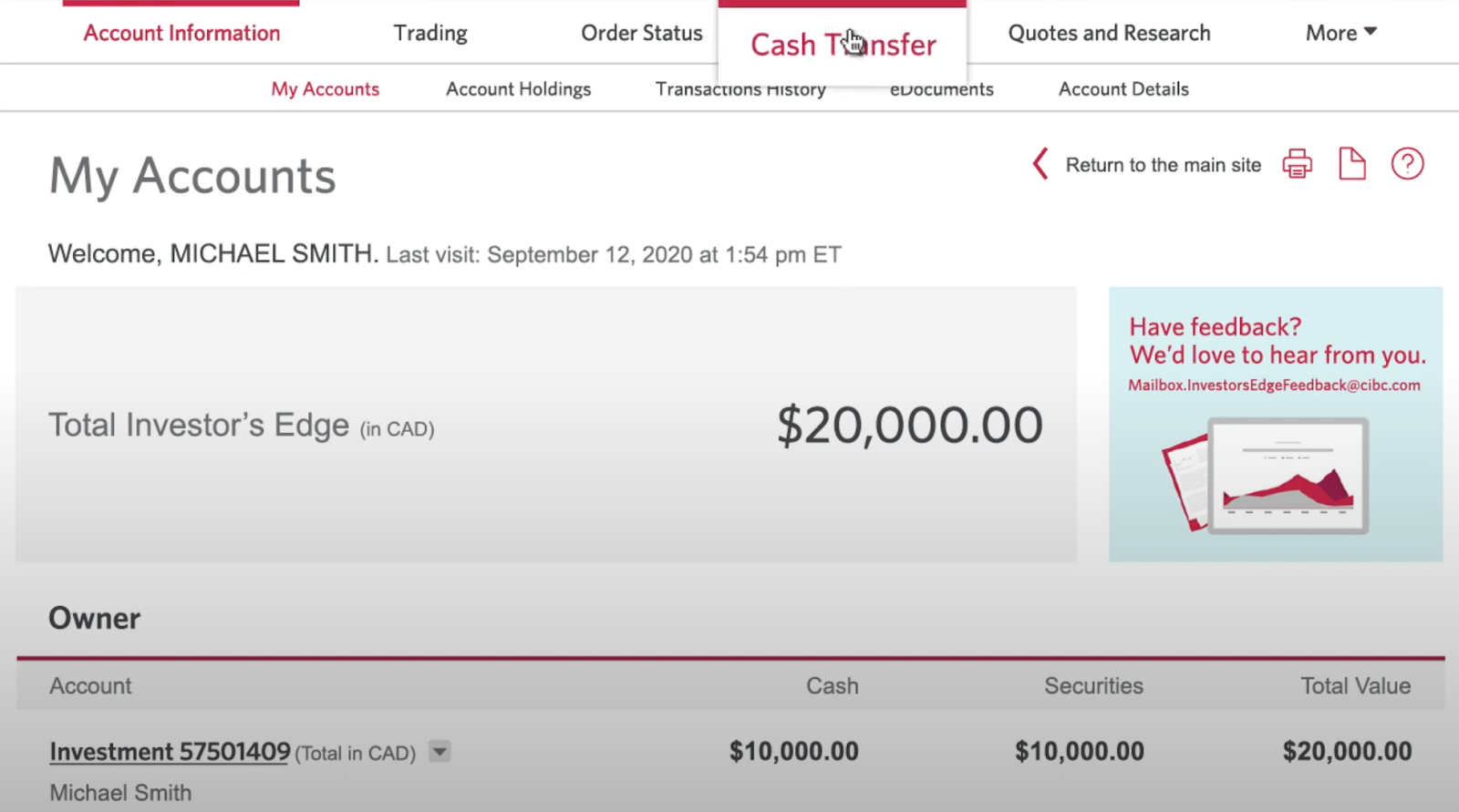

How to Convert Currency in CIBC Investor's Edge

January 24, 2023 Explore the table of contents Whether you're opening a new credit card with a low promotional balance transfer rate, consolidating your debt onto one credit card with a lower rate, or need to transfer a balance from a credit card so you can close the account, you could consider a balance transfer.

How to add e transfer to CIBC Remitbee Help Centre

Option 1: straight $6000 balance transfer. Transfer fee: $60, payback at $600/month Option 2: take $4000 cash advance, pay off $4000 of LOC, transfer CC balance of $10 000 to CIBC for 0% interest over 10 months. Pay back at $1000/month. Total transfer cost is $103.50 (1% transfer fee + cash advance fee) 1 buyupselldown • 2 yr. ago

How to add e transfer to CIBC Remitbee Help Center

A balance transfer lets you use a credit card to pay debt on another credit card. This could save you money if you're moving the balance to a card with a much lower interest rate. Card issuers often have balance transfer offers, sometimes with rates as low as 0%. How balance transfers work